Digital wealth management – why it’s all about the smartphone app

Wealth management for high net worth individuals has traditionally been associated with personal relationships, face-to-face meetings, and paper-based transactions.

However, as the world becomes more digital, high-net-worth clients are increasingly looking for digital solutions to manage their finances and interactions, and as in so many other areas the pendulum is swinging away from the digital desktop and towards the smartphone.

Why mobile is important in wealth management

Meet soaring digital expectations

The needs of high-net-worth individuals (HNWIs) are evolving and digital expectations are growing rapidly. A recent survey by Accenture revealed that 70% of HNW customers use digital financial services and 85% use at least three mobile devices. In a study conducted by McKinsey & Company, it was found that wealth management clients who use mobile apps to manage their finances are more satisfied with their overall experience.

The same McKinsey study also found that 70% of HNWIs would be willing to use a mobile app to manage their wealth if it were offered by their wealth management firm.

And finally, a survey by PwC found that 73% of wealthy individuals under the age of 45 consider mobile access to be very important when selecting a wealth management firm.

So from an expectation perspective, things are pretty clear – HNWIs’ attitudes towards technology are changing and they now expect firms to leverage digital solutions to enhance the customer experience, using the device they rely on for so much else – their phone.

Suggested reading: Designing the Future of Wealth Management: It’s All About the Experience

Improve client service – anywhere, any time

With a mobile wealth management app, relationship managers can view and respond to client requests or queries instantly, from anywhere. This minimises delays and means that HNW clients don’t have to wait for their relationship managers to get back to the office to approve requests.

Mobile apps can also facilitate communication between clients and advisors. For example, they can allow clients to schedule appointments or send messages to their advisors directly through the app. This can help clients feel more connected to their advisors and make it easier for them to get the support they need.

A wealth management app also allows HNW clients to access their financial data, portfolio and reports at any time. They will have a complete holistic view of their financial wealth including pension funds, insurance services, and estate planning – all in one place.

Provide more engaging digital experiences

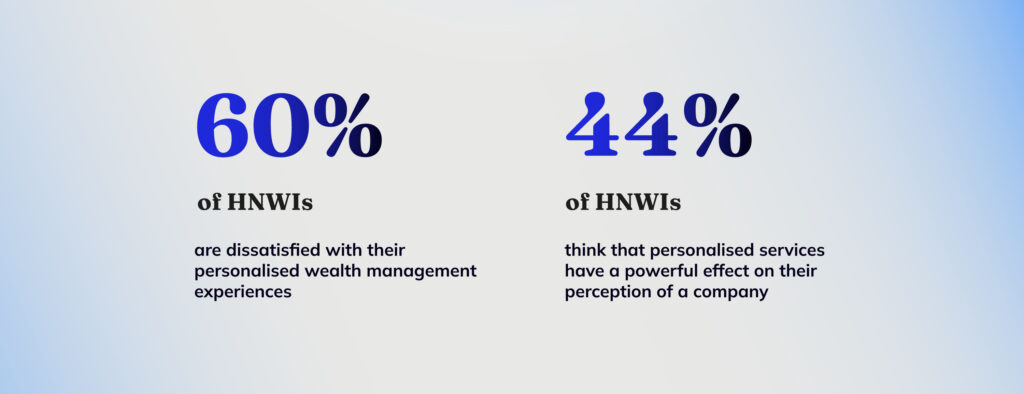

A recent survey revealed that 60% of HNWIs are dissatisfied with their personalised wealth management experiences and 44% said that personalised services have a powerful effect on their perception of a company. A phone innately has a more personal connection with its user than a laptop or PC, so it is the perfect platform on which to build this deeper relationship.

By embracing the wide range of notification options on the phone, the firm can build on the interactivity in the relationship, but also put the user in control as they use settings to decide the level of intrusion.

And the smaller screen real-estate means that most often the navigation is simpler than on the desktop, forcing app designers to focus on what is most important, and lending itself to a more accessible experience to users.

People love their phones and the well-designed apps on them. So, if done right, the phone can help build trust, strengthen the client-advisor relationship, and increase client loyalty.

Retain top talent

It’s not just HNW clients’ digital expectations that are growing, wealth advisors also expect firms to automate and innovate their processes using digital solutions.

A survey by Broadridge found that 74% of wealth advisors wish their firm had access to better technology tools and 51% are considering moving to a firm with better technology.

Wealth management firms that fail to embrace digital tools, like well-design mobile apps, risk losing top advisors to competitors with better technology.

The growth in mobile apps for wealth management

Mobile apps are becoming increasingly popular in wealth management, particularly among the younger generation. The J.D. Power 2022 Wealth Management Digital Experience Study revealed that wealth management apps score the highest for satisfaction and brand loyalty among young users.

Industry experts predict that the use of mobile apps in wealth management will continue to grow at a rate of 20% per year for the next five years.

According to Michael Foy, senior director of wealth intelligence at J.D. Power:

“Wealth management firms that want to attract and retain younger investors need to focus on continuing to improve their mobile apps. The mobile app is becoming the centre of the modern wealth management client user experience.”

Four things to bear in mind

Although the direction of travel is clear, firms do need to consider a few key aspects to get right:

Security

It is critical that clients believe that their sensitive information and all interactions are protected and that the app is secure. Discussing these concerns up front and describing how the bank is addressing them can reassure clients that their information is safe.

Customisation

While we touched on personalisation, it’s essential to note that mobile apps should also be customisable to meet the unique needs of each firm and its clients. Advisors should be able to tailor the app’s functionality to their workflows, and clients should be able to personalise so that the experience works for them.

User experience

The mobile app will need to provide a user-friendly and intuitive interface that is easy to navigate and understand. This will require a very real focus on user experience design and testing to ensure that the app meets the needs and expectations of its users. Client expectations are huge and people like to be surprised.

Innovation

Nothing stands still and firms need to have the appetite to invest in their apps and continue to innovate and evolve in response to changing market trends and emerging technologies. This will require a focus on research and development, as well as a willingness to take risks and experiment with new features and services.

Summary

Technology is causing huge disruption in the wealth management sector and advisors are coming under increasing pressure to provide seamless mobile wealth management experiences. Firms that combine mobile solutions with a human-centric approach will be well-positioned to thrive in the new digital era.

“With the rise of mobile, wealthy investors expect financial services providers to be always-on, easily accessible, and most importantly, proactive in understanding their needs and preferences.” – EY Global Wealth & Asset Management

Topaz is helping firms embrace mobile wealth management

Topaz consists of an extensive set of apps that enable holistic reporting and collaboration through a peerless, premium client experience. It is also a toolkit that accelerates the creation of new digital experiences, along with a services hub that facilitates engagement with multiple providers.

Our modular experience and technology platform is helping financial institutions transform their digital offering, enhance client-advisor relationships, and improve firm efficiency and compliance.

If you want to find out how Topaz can help you embrace digital transformation and provide the ultimate HNW client experience, sign up today.