Future of Goal-Based Investing with Topaz

Goal-based investing is becoming increasingly attractive to High Net Worth Individuals (HNWIs). Several factors are driving the transition among wealth owners from the traditional, long-view-only approach to investing using a goal-based approach.

Firstly, there has been a recognition that the singular goal of attaining maximum net worth by retirement (or death) is not necessarily ideal. Life has many inflection points and milestones that require a range of investment horizons/risk appetites. Secondly, goal-based investing can mitigate systemic risks such as financial crises, which can have a particularly severe effect as one approaches retirement and time available to rebalance a portfolio reduces.

What is Goal-Based Investing?

“Goal-based investing (GBI) involves a wealth manager or investment firm’s clients measuring their progress towards specific life goals, such as saving for children’s education or building a retirement nest-egg, rather than focusing on generating the highest possible portfolio return or beating the market.” (Investopedia)

At Topaz, we believe that incorporating GBI into your wealth management strategy can help you become a client experience leader in the industry. Our platform is designed to make goal-setting and risk assessment simple and powerful, allowing for spontaneity without sacrificing due diligence.

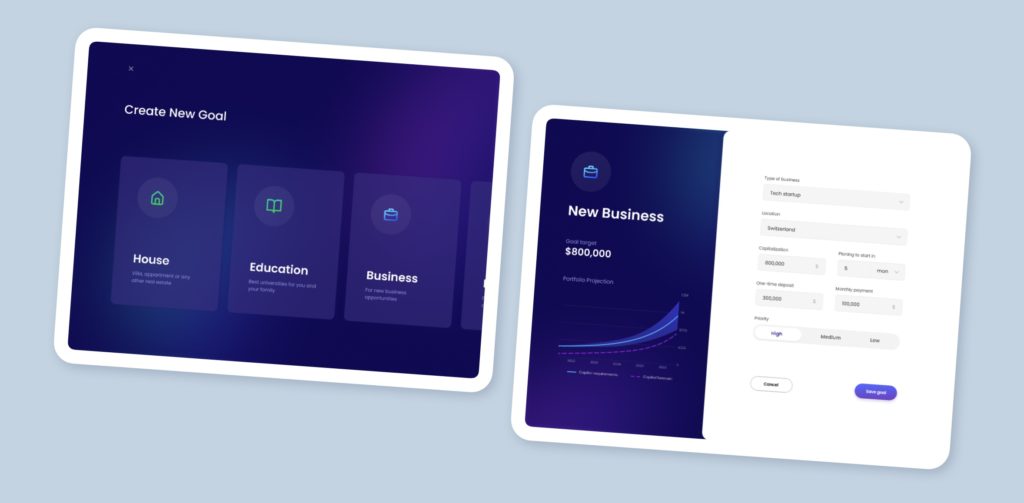

We envisage an app where you can create and view your client’s financial and non-financial goals in one dashboard, grouped by category and priority. You can input goals related to family, real estate, travel, or other categories, and Topaz will help you monitor progress towards each goal.

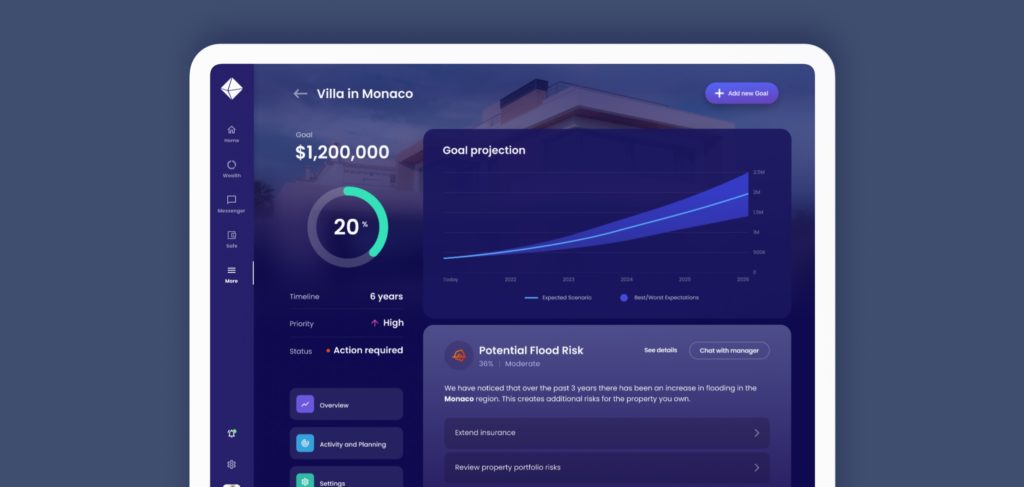

An AI-enabled solution would take into account the client risk profile and investment preferences, such as environmental, social, and governance (ESG) considerations, to set targets against a timeline. The system simulates investment performance and monitors progress towards goals, providing timely updates and feedback.

By using a goal-based approach to investing, you can mitigate systemic risks, better align client investments with values and lifestyle, and create a more holistic and personalized wealth management strategy.

A Smart Approach to Goal-setting

So, in essence, the user inputs goals into Topaz which then combines them with the user’s risk profile and priorities, and sets targets against a timeline. The user’s investment preferences (e.g. ESG) are applied, and the system simulates investment performance. Progress towards goals is monitored and fed back into goal-setting for steadily improving results.

What if… is Topaz Digital’s multi-format series pushing the envelope on what’s currently possible in serving the needs of private clients while demonstrating the platform’s possibilities. These concept articles and videos suggest where firms need to go to become client experience leaders in wealth management.

Ready to take your wealth management firm to the next level with AI-powered aggregated reporting solutions? Visit Topaz Digital’s website at www.topaz.digital or contact us at www.topaz.digital/contact-us to learn more. Our team of experts is committed to helping you create your future-facing client experience.