AI in Wealth Management: Disruptive Challenges, Transformational Opportunities

Vision for the Future

In an era when technology defines the ability of enterprises to compete more than ever before, AI has quickly shifted from a largely notional technology to a foundation for real-world applications with tangible, far-reaching business value. These applications promise to be lucrative for those that understand how to bring them to market, and highly disruptive for industries throughout the economy.

As business-practical AI-based solutions begin to become more commonplace, wealth management firms are emerging as key early adopters of AI/machine learning approaches. The biggest industry-leading wealth management firms are already investing serious capital in this area—and for good reason. The unique demands of this industry add up to an operational environment where even relatively straightforward AI implementations can offer both greatly improved customer offerings and substantial internal efficiencies.

For now, AI-based applications are “supporting actors” for the lead role played by human wealth managers. Many industry analysts, however, see AI taking over the leading role sooner rather later. Whatever the case, understanding this trend is increasingly essential for wealth management firms trying to stay competitive in the 21st century.

These newfound efficiencies also allow for highly specialized strategies that simply wouldn’t be feasible using traditional wealth management practices. We’re already starting to see startups, backed by AI-based tools, aggressively challenge key niches in the wealth management industry. This disruption will drive more differentiated offerings than ever before, and a fiercely competitive environment for traditional corporate giants in the industry.

Core Applications of AI in Wealth Management

1. Data Analytics

Firms are collecting more data than ever before. In fact, many firms are swimming in so much data that actually utilizing it is a profound challenge. The sheer scale of analysis required is, in many cases, beyond cost-effective human capabilities. Meanwhile, in wealth management particularly, the insights generated from this analysis are more valuable the more quickly they can be generated and communicated to key decision makers.

Largely automated data analysis deployments can help wealth management teams:

- Make use of deeper datasets than ever before (without dozens of quantitative analysts on staff).

- Analyze this data faster for crucial market agility, going from raw intel to actionable insights in a matter of minutes or hours rather than days or weeks.

- Better understand customer behavior to assist in financial product marketing, customer service, customer segmentation, and customized product offerings.

2. Forecasting

Forecasting market movement is a notoriously thorny intellectual problem. And it’s a challenge that has to be solved in a context where time is quite literally money. Perfect financial foresight has limited value if competitors arrive at the relevant insight first.

AI-rooted techniques utilize machine learning principles to automatically learn from the vast sea of data inputs that can potentially be used to predict asset price movement over a desired time frame. Even for firms that don’t rely on purely data-driven forecasting, AI-driven insights can act as a powerful safety check for a wealth manager’s own insight into the market.

AI-based approaches are also exploring new forecasting frontiers altogether. Wealth managers are increasingly employing “sentiment analysis” using the wealth of data available through social media and financial news data mining. [1] These data sets give machine learning algorithms an opportunity to—in real time—reach even deeper into the fundamentals of brand value, customer loyalty, and other evasive but crucial marketing realities.

3. Risk Management

Financial analysts are actively utilizing AI/ML to identify new price signals and to make more effective use of the vast quantity of available data and market research. Far more inputs can practicably be utilized compared to current modeling approaches. [2] Machine learning can help identify signals from data to generate predictions relating to price level or volatility over various time horizons.

4. Robo Advisor

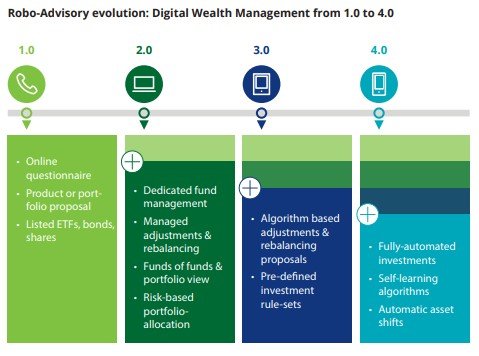

AI applications are also taking a more active operational role in in the client-facing side of the business, helping wealth managers advise clients at key points. The figure below shows the rapid evolution of Robo-Advisor capabilities as the tech advanced from version 1.0 to version 4.0.

Figure 1, from Deloitte, “The Expansion of Robo-Advisory in Wealth Management.”

A hybrid-style robo-advisory (Version 3.0) is the most common current application. In this model, an investment manager utilizes a digital platform for portfolio-rebalancing, asset allocation, and service quality optimization. We expect to see V4 style implementations begin emerging more frequently soon, where a robo-advisor will manage the portfolio without any human intervention at all. [3]

What’s Next for AI in Wealth Management?

We have already seen some consolidation in the wealthtech market, with banks partnering with fintech firms (or acquiring them). We expect to see major banks begin using similar technologies to gain a greater piece of the wealth management pie. And there’s no reason to expect that this disruption won’t occur sooner rather than later.

Meanwhile, while the hybrid-advisory model is already gaining popularity, the next logical step for self-learning algorithms may become market relevant sooner than many industry players expect. According to an article by Investment Week more than half of HNWI clients said they believed that artificial intelligence would mostly replace traditional, human-based portfolio management over the next five years. [4] That doesn’t mean human wealth managers will be obsolete: rather the opposite. By automating the tasks that are most inefficient for human wealth managers, we can free them to focus on what they do best: building advisory relationships built on trust, personal knowledge, and a deep understanding of client needs.

In this new age for wealth management platforms, AI-driven systems are bringing efficiencies, improving performance and reducing risk. But we mustn’t forget that this needs to coalesce, along with the interaction of the advisor, into a meaningful experience for the clients. The translation of these benefits into a highly effective, and holistic digital mobile and web experience, incorporating investment insights, collaboration tools, and intuitive workflows, is imperative if the potential is to be fully realised.

References:

- https://ieeexplore.ieee.org/document/7752381/

- http://www.fsb.org/wp-content/uploads/P011117.pdf

- https://www2.deloitte.com/content/dam/Deloitte/de/Documents/financial-services/Deloitte-Robo-safe.pdf

- https://www.investmentweek.co.uk/investment-week/news/3034206/how-will-ai-help-wealth-managers-in-the-future